the one where we talk about MONEY, honey 💸🍯

summer school session II with Katie Gatti Tassin, founder of Money With Katie

hi, friends!

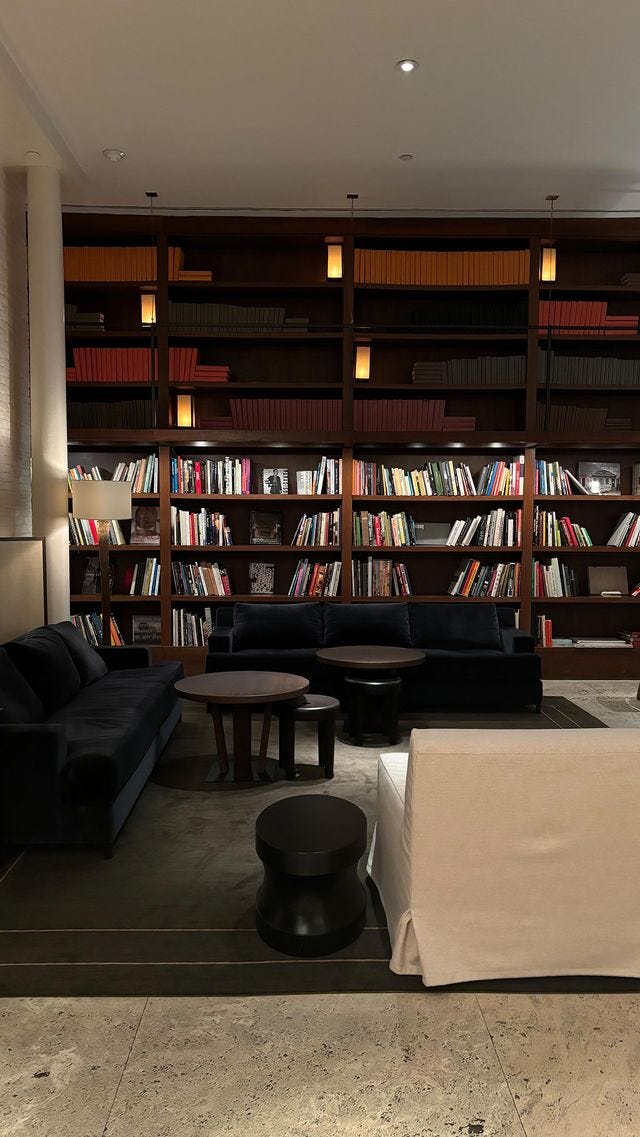

we’re not supposed to jump on the bed, and we’re definitely not supposed to talk about money. but today, we’re going to do a bit of both! the pic above was captured on Wednesday morning after we held our August West Village Book Club meeting at The Mercer Hotel. it was a truly idllyic night and an actual “pinch me” moment to wake up in this iconic Soho hotel with my WVBC endorphins running on high. @westvillagebookclub is approaching our second birthday in October, and I couldn’t be more grateful for just how full this group of book-loving gals has filled my cup.

but now for a hard pivot. if you know me, you know the overlap between work, finance, and feminism in all its forms consumes a great deal of my thoughts. the way in which I’ve approached these topics continues to evolve, but ultimately, when it comes down to it, privilege and access are the defining characteristics of my experience on this planet, so I’ve never really talked about money in my newsletter. I didn’t think it was my place to do so.

I’m also really conscious that I don’t want to have to mine the darkest wells of my personal life for subscribers, shares, and comments. but I’m equally aware of the power of vulnerability and how much I’ve learned and gleaned from brave strangers on the internet who pull back the curtain on their life. so, I want to strike a careful balance with this topic. I’ve thought critically about what I’m comfortable sharing and what isn’t even mine to share in the first place—for instance, the money scripts I grew up internalizing because of where and how I was raised.

so I’ve landed on painting a picture that weaves together what was going on in the world as I made my way into it as an adult and some of the things I’ve faced along the way. the older I’ve gotten (I turn 31 four weeks from today), the more I’ve realized that money—and the ability to make more—isn’t one-dimensional. conversations like this require recognizing where privilege exists, navigating the fraught political landscape, grappling with the seemingly dead American dream, and continuing to fight for gender equality. so, while I won’t be able to account for every nuance, this is my version of events. shall we dive in?

“it’s not polite to talk about money”

…is a script we’ve all heard since…well, forever.

then, we started in the working world and most of us didn’t know which way was up. we just knew that after getting taxes taken out and paying our bills, there wasn’t nearly as much disposable income available to us as we’d thought there would be. is THIS what our parents were always complaining about?? we didn’t want to turn into our parents—no one does, but life was so much more expensive than we’d bargained for! we had to learn about auto-pay, insurance coverage, co-pays (why is it such a mystery what it’s going to cost to go the doctor? should I say ‘yes’ to these tests they want me to run, or is it going to bankrupt me when I get a bill in the mail in two months?), APR, pre-tax deductions, 401k contributions, managing a million subscriptions, and ultimately, the difference between a WANT and a NEED.

am I getting ahead of myself? perhaps. but we’re gonna go there. and while I’m writing this one for you guys, I’m also writing it for myself. call it delusion, or perhaps some version of exposure therapy, but somehow, sharing my thoughts on a sacred and usually SECRETIVE topic like money feels right as I welcome Katie Gatti Tassin, founder of Money with Katie, to the sunday series. and we’ll get to me and Katie’s Q&A soon, but first, a little storytime…

when I graduated in 2015, the girlboss era was upon us—until it wasn’t.

to set the scene for the landscape when I entered the workforce, Barack Obama was finishing up his second term in office. the United States Supreme Court had just legalized same-sex marriage nationwide. “the dress” being blue and black or white and gold had set the internet on fire. and all the while, as a fresh graduate, I was offered a job as a retail travel consultant making $14.42 an hour. I happily took the gig but was suffering from severe whiplash after a full year of travel (after interning in D.C. the summer before my senior year, I split my final two college semesters between France and India) abruptly came to an end, and I was settling into a seemingly smaller life living back at home in western NY. I went from having my carefree college life predominately funded by my parents (enter: the privileged part) to being told, “okay, playtime is over. time to get started on what’s about to be forty-five years in the working world now!”

by 2016, I’d left the nest, moving to New Jersey for a new job (in marketing) at the same travel company where I started my career the year prior. I’ll never forget going from making $30,000 as a travel agent to $50,000 (!!) working in social media management and thinking I was RICH. though that delusion didn’t last long. I soon realized that with a car payment, car insurance, health insurance, a cell phone bill, student loans, rent, utilities, groceries, and the bare bones of my new adult life, I was in the negative month after month. I was the epitome of living paycheck to paycheck—experiences like getting my card declined at Trader Joe’s were not out of the norm. I was 23, recently single, and honestly, really, really stressed that I wouldn’t be able to figure it out. at a baseline, anxiety and a burgeoning scarcity mindset began to rule my life.

just a few months into my new job and life in the burbs, Hillary Clinton lost the Presidential election. I remember crying at my desk on the day of Trump’s inauguration—a somber mood cast over our women-led fifty-person marketing team. though naturally, there was a golf-playing, polo-sporting white male amongst us who couldn’t have been happier to see his candidate being sworn in as we all watched the live stream from our desks in tears!!!! ironically, none of us knew how much WORSE it was going to get—that four years later, the very same notion of an inauguration and change of power would be SO divisive that it would incite an insurrection.

but back to 2017. women-only coworking spaces like The Wing set up shop and were thriving off our communal female rage. companies like Chillhouse cropped up, wooing us with their marketing predicated on us needing to chill the eff out and happily taking our self-care dollars with the promise to help make it happen. but I couldn’t chill out, and I definitely couldn’t afford a manicure in Manhattan. at one point, I was working my corporate job so I could continue to get experience on my resume, pulling shifts at a café and doing freelance social media management for a health coach for extra cash.

when I think back on this point in my financial journey, there’s so much I wish I could change, but a part of me also feels like I NEEDED to go through it. I needed to get my ass kicked a bit. and what I really needed but didn’t deserve was the generosity of one of my best friends who, when I came to her and told her I was throwing in the towel and moving back to Buffalo because I couldn’t afford life in the tri-state, said, “give it a couple more months. move in with me.” aside from the way that chapter forever cemented our friendship as we worked our corporate jobs at the same company and trained for the NYC marathon together on the weekends, that act of kindness was what allowed me to get where I am today.

2018 was a turning point in my professional trajectory and, ultimately, my financial journey. ironically, TODAY marks the six-year anniversary of my being with my now company. how’d I get the gig? well, I spilled the story a long time ago in my contribution to The Everygirl, “How I Slid Into My (Now) Boss’s DMs to Land My Dream Job,” including the part about the United Club prosecco buzz that gave me the courage to shoot my shot. a laundry list of incredible opportunities has come my way since, but as I look back at the last nine years of finding my way through adult life, figuring out my financial footing has unequivocally been the trickiest part.

I could write about moving to the city and how this cycle of not-enoughness persisted with an increased cost of living. I could write about how the pandemic gave me the breather I didn’t know I needed, but honestly, none of that feels relevant to our conversation about money today. weaving the narrative of how interconnected the constant pursuit of MORE is, does, though. asking for more, spending more, and keeping the cycle of consumption going has been a defining characteristic of my twenties and early thirties.

but we were told we deserved more, right? I look back and think about how copies of Sheryl Sandberg’s Lean In used to litter our bookshelves. until, OH WAIT, it was “The End of Leaning In.” actually, no, scratch that!!!! we decided Sheryl didn’t get feminism “right” ten years ago, but she also didn’t get it completely wrong. Lean In feminism simply needs a more nuanced look. there’s been a shift in the cultural tide around how we talk about these things both at work and at home, and we’ve been left in the wreckage, expected to balance being our own best advocates and not sounding entitled when we constantly ask for MORE.

by 2021, it was declared that "The Girlboss is Dead.” no more working from millennial pink coworking spaces. no more keychains that said, “GIRLS DOING WHATEVER THE F*CK THEY WANT IN [insert year]” dangling from our wrists. no, really, I bought one of these keychains at The Wing in 2019, and I’m CACKLING at finding the photo below in my camera roll. the gel nails (complete with a design I surely paid more for) are what really sent me over the edge….

discussions about the Pink Tax feel like child’s play compared to the fact that in 2022, Roe was overturned, and suddenly, the threat to our bodily autonomy also felt like an assault on our ability to safeguard our futures. for me, ALL of it is connected. and while I’m lucky enough to live in New York State, where we still have the right to choose, twenty-two states have restricted or banned the procedure in the last two years. 171,000 Americans traveled for abortions last year. and all the while, the gender wealth gap has persisted.

if your head is spinning, mine is too. as I look back on what’s changed in the world since I graduated college, it would be easy to focus on the negative and be filled with disappointment. maybe even a sense of existential dread. but then I remember that we have a female candidate leading the Presidential ticket again!!!!!! and it’s not 2016. in 2024, we’re living in the era of the Eras Tour and brat summer. dollars are being put back into women’s pockets, and we have greater access to financial literacy than at any other point in history. we have creators like Katie who are talking about money, not just in more easy to understand terms, but from a decidedly female lens. actually, I’m going to link one of my fave Money With Katie episodes ever below so you can get a taste of what I mean! because if a financial expert talking about ‘the hot girl hampster wheel’ is isn’t completely my bag, I don’t know what is.

and that brings me to my final point in today’s essay, dear reader. next month, I’m turning on paid subscriptions to the sunday series.

when I launched this newsletter back in May 2020 and then brought it over to Substack in October 2023, I never imagined it would consume as much of my time as it now does. and I love that it does. I love that I have this outlet and this growing community to share everything from the random TikToks I send my sister to deeper, more meaningful shares like today’s chat about money. but the reality is that I want to go even deeper, and I don’t feel comfortable doing so on a publicly accessible forum like this one. putting a paywall in place will help protect not only my time but also my peace as I dig deeper into this creative outlet that I hope also provides you with some value. so, just a heads up that things will be changing soon! there will continue to be some elements that are available without a paid subscription, but I’m looking forward to unveiling some new paid subscriber-only content soon. xKD

meet Katie Gatti Tassin

As a former public relations major in corporate America with a penchant for swiping her Discover card, Katie’s obsession about personal finance hit her hard out of left field — and as she watched her net worth grow in tandem with her financial literacy, she realized just how valuable the information was. Sharing it with others became an obsession. Katie left her full-time job at the end of 2021 to devote all of her energy to building her business, and Money with Katie was acquired by Morning Brew in 2022. Today, she runs Money with Katie as part of a team of three, and they’re rapidly growing their reach.

Kayla Douglas: Katie, before we wind back through your career path, tell us a bit about what you do today through your work at Money With Katie.

Katie Gatti Tassin: My goal is to wake up every day and make really cool, thought-provoking work about money. Most often, that means playing around in the area where finance, psychology, culture, and politics meet up and mix together in interesting ways.

KD: You weren't always in the personal finance world. What were some early career choices that led you to wind up pivoting?

KGT: Mostly my decision to study public relations, which meant I knew I'd always be on an income-constrained path! I knew I wanted to write, and someone told me in high school that if you want to make money as a writer, you should study PR (unsure where they heard that advice, because it's definitely not true, ha). In retrospect, I would've studied journalism and finance. All in all, my own interest in getting my financial shit together paired with my love of being opinionated and talking a lot birthed my ideal career. Thank God I was born in 1994; can you imagine me trying to make a go at this pre-Instagram, podcasting, etc.?

KD: How do you approach the realm of personal finance in a way that feels authentic to you versus following the traditional blueprint in such a male-dominated space?

KGT: Mostly because it never occurred to me to try to do it their way, I guess! Bless my naïvete. Though I'm sure you could point to a lot of my early work and say it did more closely resemble everything they were doing back then—but I got bored with that stuff pretty quickly.

There are only so many ways you can implore someone to use a 401(k) before you get distracted by something way cooler, like the beauty industry targeting women's capital.

KD: You launched Money With Katie in 2020 before ultimately going full-time in 2021 and being acquired by Morning Brew in 2022. How have you approached growing and scaling your business to best align with your vision for your life as an entrepreneur?

KGT: For a long time, my number one focus was making as much money as possible (within reason; I wasn't taking advertising dollars from crypto bros), because my ultimate goal was being financially independent and retiring early as fast as possible. Then I realized my real goal was to write stuff I was proud of and become a smarter, more well-rounded person, and often that's at odds with the "make as much money as possible" path. It's the reason why we didn't start selling expensive courses or doing coaching—that would've been the most profitable path, but it also happened to be the one that made me want to fall asleep at my desk. My guess is that I'll make less money next year (probably by a wide margin), but that I'll make better stuff and have more down time, both of which are ultimately more important to me now.

KD: Speaking of, what does an average "day in the life" look like?

KGT: Because I live in California (the desert part, not the cool part) and my team lives on the East Coast, usually late mornings are the best time for meetings—so I'll allot two hours (usually from 10 to 12) for meetings. Before that, I'll usually focus on research and writing work for a couple of hours (call it 8 to 10, sometimes earlier if I'm up and inspired). Early afternoons are worthless for me and I'm unwilling to concede that it's probably an espresso crash, but I usually get a second wind in the late afternoon and will knock out another hour or two of "real" work. All in all, I try to spend as much of my working time each day on producing something or investigating something, rather than playing Slack ping pong or stalking around an inbox (which also happens to be why I'm terrible at responding to things in a timely fashion, because I'll go days without checking).

KD: You sold a book! What will it focus on, and when can we expect to see it on shelves?

KGT: It's basically my entire financial philosophy distilled into 7 chapters that nestle all the tactical, practical personal financial topics women face within the historical, political, and sociocultural context that created them. E.g., we're not just talking about negotiating—we're talking about the controlled gender wage gap and the fact that women are overrepresented in low-wage work. I wanted to write something really instructively robust without sacrificing the sociological reality of the policy decisions and gender norms that got us to this place. It's coming out in May 2025, and it's called Rich Girl Nation.

KD: What's the best part of working for yourself?

KGT: If I ever work for myself, I'll let you know—I'm technically employed by Morning Brew, so I've never actually been fully self-employed. But to the extent I do now, the best part is having self-determination to follow my interest and curiosity.

KD: On the flip side, what are some of the things (that Instagram may not see) about running your own company that you'd advise people they need to be ready for before going out on their own?

KG: This might not be something that everyone experiences, but I'd say the "giving a shit" fatigue is real. When I worked for big companies, I didn't think about work outside of work. My weekends were like going to another planet. Now, I feel like I'm just constantly sort-of-working, and the stakes feel so much higher. Sometimes I miss the before-times of caring less, but ultimately it's a tradeoff I'd make every time.

KD: Beyond work, what inspires you?

KGT: People who engage in community organizing, independent writers and thinkers who are delivering really salient political messages in entertaining packages (my favorite being If Books Could Kill from Peter Shamshiri and Michael Hobbes), and basically all single moms. Sometimes I think about the amount of work and determination it takes to raise a family in this country—particularly without any help—and it reminds me I should basically never complain about burnout, ha.

KD: What's next? What are you looking forward to as we approach 2025?

KGT: I'm looking forward to engaging with more ideological projects that don't shy away from a point of view, like OFF DAYS (where I publish essays not about money) and Diabolical Lies (a co-hosted show I'm doing with my brilliant internet pen pal, caro claire burke, which uses pop culture commentary to debunk the most pernicious elements of patriarchy).

I love this!!